Accounting, Tax & Bookkeeping services for businesses and individuals across Canada.

Our professional accountants are here to help.

Trusted by hundreds of Canadians and their Businesses

Our accounting firm uses advanced cloud technology to deliver customized solutions to businesses across Canada.

Cloud Accounting

A business succeeds when it understands its financial health. Our accounting firm provides the insights a business owner needs to make vital decisions, track revenue, forecast for the future, and report or present to investors and stakeholders. Our professional accountants provide an in-depth look at your books so you don’t have to think twice about it!

Bookkeeping

Let a professional bookkeeper handle your books! Focus on the day-to-day of your business while taking comfort in knowing that your digital records are automatically backed up, providing enhanced security and audit protection. And with our accounting firm’s step-by-step guidance, the transition to cloud bookkeeping services will go off without a hitch.

Payroll Services

Tired of managing payroll? We’ve got you covered! Our accounting firm can manage the entire payroll function of your business and give you peace of mind in knowing that your company’s payroll obligation is fully compliant with the CRA. We’ll set up employee payments through direct deposit, create pay stubs, remit payroll deductions, and file the T4 return.

Corporate Tax

Don’t lose sleep at tax time, let our accounting firm manage your year-end! Our Chartered Professional Accountants will analyze your business’ unique tax situation, optimize the tax return, file it with the CRA, and provide advice on how you can further minimize your taxes. And with our tax compliance health check, you can trust that your business will always be compliant with the CRA

Financial Statements

Our accounting firm can take the information you provide and turn it into clear and easy-to-understand Compilation Engagement Report (formerly known as NTR Notice to Reader Financial Statements). With the Compilation Engagement Report in hand, you can review the company’s financial performance or provide it to the bank for loan approval.

Learn more about the accounting support you deserve!

Testimonials

What our clients are saying about us!

Our accounting firm provides some of the best cloud accounting and tax services in the country. But don’t just take our word for it, here is what some of our clients have to say:

Read More

I love the online approach that William and his team implements. It makes the process extremely easy. The deliverables are always on time. The tax advice we got are very helpful and practical. The team is always there whenever we have a question. Excellent work!

Read More

William is very knowledgeable in the e-commerce space. He educated me on the sales tax requirement for selling to different provinces and he also helped the company set up the backend system so that the accounting system, inventory system, Amazon, and Shopify are synchronized. Highly recommended for anyone looking for a modern-day accountant that works well with technology.

Read More

It's been a wonderful experience with William, who has sound knowledge of tax regulations and helped my business set up a structure to minimizes tax. His team is well proficient in handling both bookkeeping and payroll process. I am a satified with their work and highly recommended.

Read More

Whenever we have an accounting or a tax question, William was there to answer them. His advice helped us save a tremendous amount of taxes each year. He is also looking after the company’s books and has been keeping us up-to-date on the company’s performance each month. Excellent work!

Read More

William Chong is fantastic. I have had many other accountants in the past, but nobody has done such a great job. Very efficient, knowledgeable, responsive, and his fee is very fair. I highly recommend his company. Thank you William for your outstanding service!

Read More

I am very pleased with and highly recommend the accounting and consulting services WTC has offered. William manages my taxes, financial statements and corporate filings so that I can have peace of mind to concentrate on my other aspects of my business. He also provided me with invaluable, actionable advice on methods to streamline and expand my business.

Read More

The team at WTC did an amazing job helping my online business set up everything I need. Mohamed and William helped me incorporate my business, set up payroll and did the bookkeeping and year-end tax return. I recommend WTC Chartered Professional Accountant to anyone who needs an accountant to help set up their business.

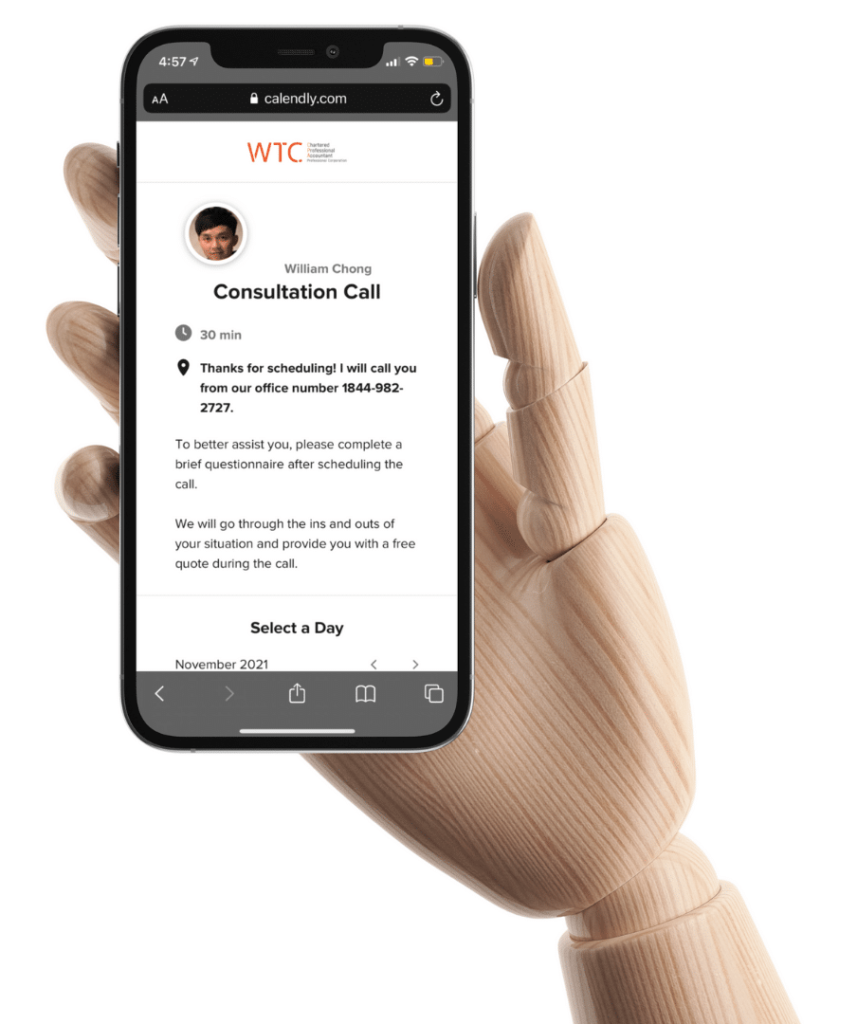

We Are An Online Accounting Firm

WTC offers Canada-wide online accounting, bookkeeping, and tax preparation. If you are considering moving your system online, here are some of our favourite cloud accounting apps:

Resources

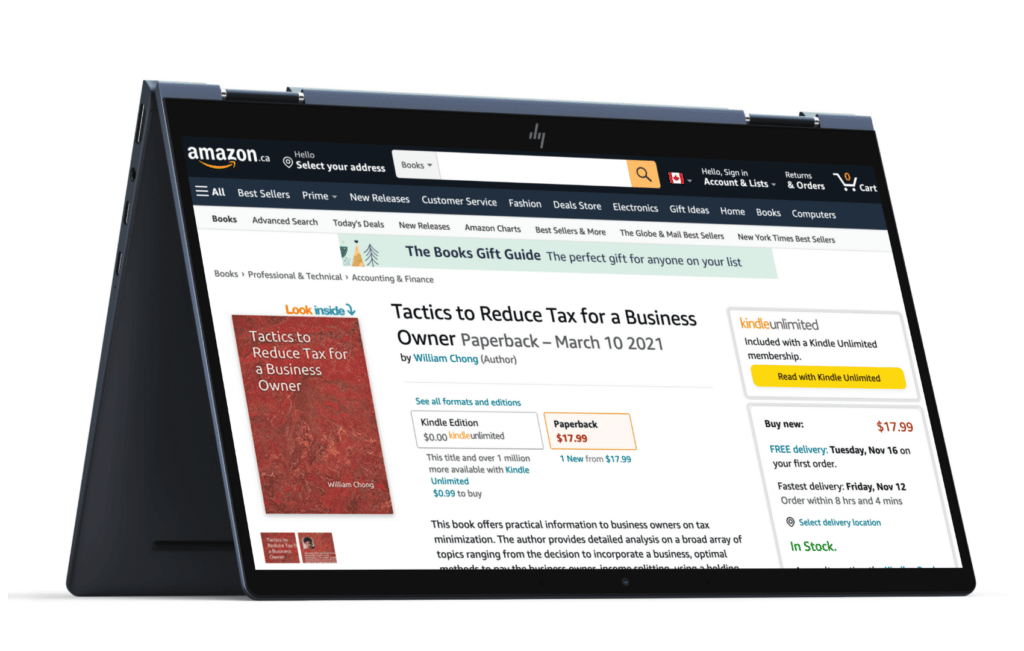

Read our #1 best selling book to minimize your taxes

Financial success begins with learning and understanding. We have created the necessary resources to help you get to where you need to be.